Pwc Philippines Tax Calendar. This calendar is issued prior to the release of the official schedule prepared by the bureau of internal revenue and other government offices. Pwc philippines 2024 tax calendar 🗓️ stay organized and never miss an important deadline with our comprehensive calendar that.

15 [revenue memorandum circular (rmc) no. Personal income tax (pit) due dates;

A Collection Of Current And Important Tax And Legal Rulings, Issues And Updates In The Philippines.

Corporate income tax (cit) rates;

The Tax Year Runs From 1 January To 31 December.

21 [revenue memorandum circular (rmc) no.

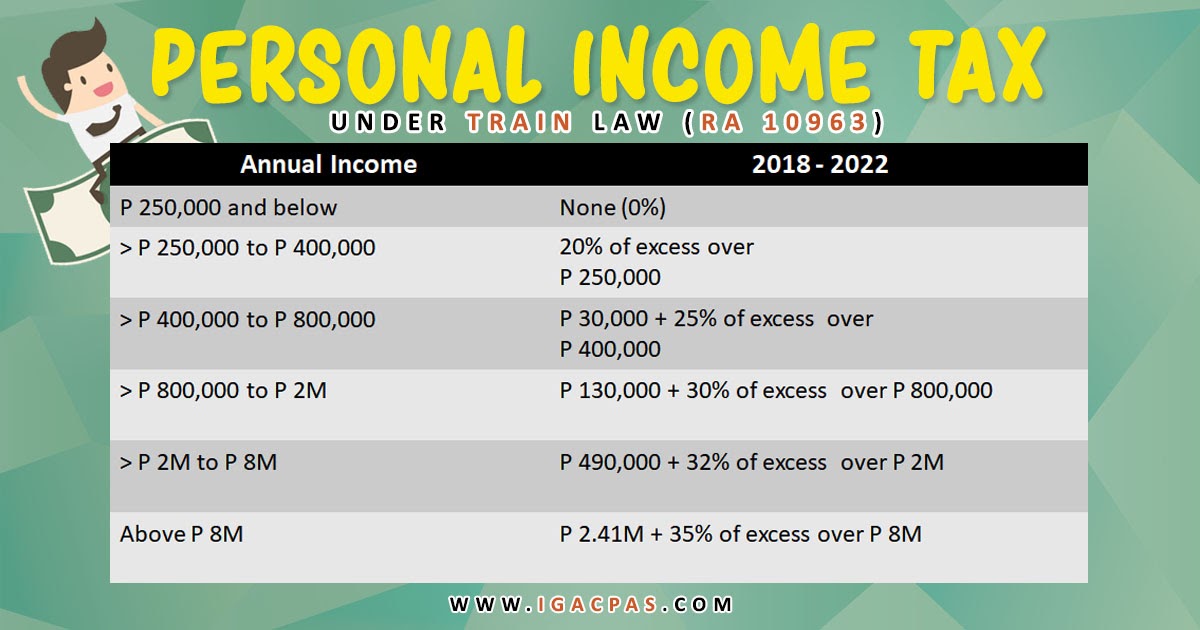

Personal Income Tax (Pit) Rates;

Images References :

Source: www.pwc.com

Source: www.pwc.com

Tax Calendar PwC Philippines, The tax year runs from 1 january to 31 december. Personal income tax (pit) rates;

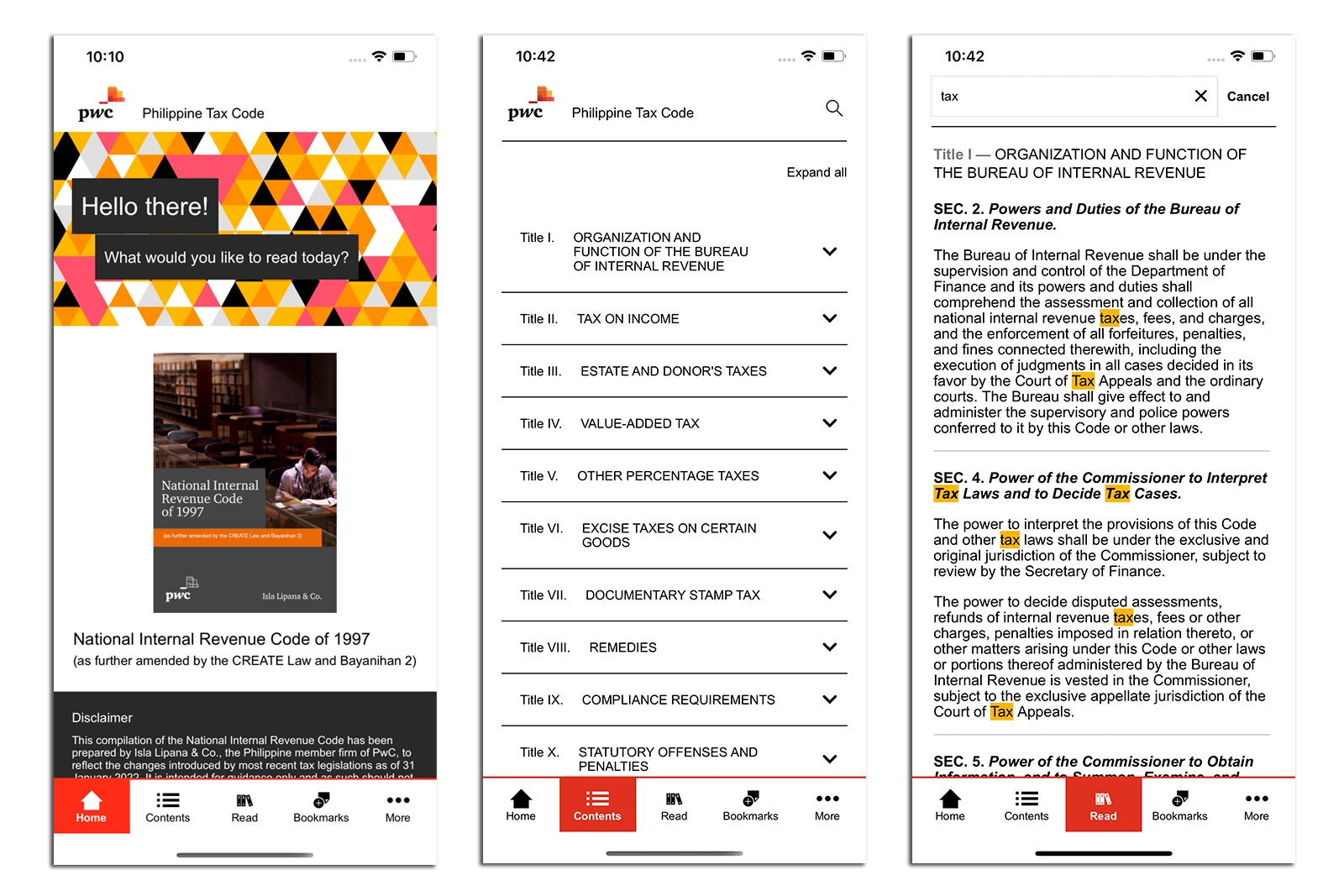

PwC PH Tax Calendar Apps on Google Play, Corporate income tax (cit) rates; Corporate income tax (cit) rates;

Source: www.bizzlibrary.com

Source: www.bizzlibrary.com

Pwc Ph Tax Calendar, Personal income tax (pit) rates; Unless impracticable, a husband and wife must file one consolidated income tax return, but the.

Source: www.pwc.com

Source: www.pwc.com

The Philippine Tax Code App, Deloitte philippines’ 2024 tax calendar details. 21 [revenue memorandum circular (rmc) no.

Source: www.pwc.com

Source: www.pwc.com

Tax Calendar, Corporate income tax (cit) due dates; Stay organized and never miss an important deadline with our comprehensive calendar that includes.

Source: www.pwc.com

Source: www.pwc.com

Register Tax Calendar PwC Philippines, The philippines taxes its resident citizens on their worldwide income. Personal income tax (pit) rates;

Source: www.facebook.com

Source: www.facebook.com

PwC Philippines 🔔 Tax deadline alert 🔔 The efiling and… Facebook, Corporate income tax (cit) due dates; The pwc philippines tax calendar is available to you, anytime and anywhere.

Source: www.pwc.com

Source: www.pwc.com

Isla Lipana & Co./PwC Philippines opens Davao office on its 100th year, This 2024 tax calendar is designed to help you meet your tax obligations and to keep track of important tax dates during the year. The tax year runs from 1 january to 31 december.

Source: igacpas.blogspot.com

Source: igacpas.blogspot.com

Philippine Personal Tax Rates (2018) Ines Gopez Amarante and Co., The pwc philippines tax calendar is available to you, anytime and anywhere. Availability of bir form no.

Source: www.youtube.com

Source: www.youtube.com

THE BASICS OF PHILIPPINE TAXES PHILIPPINE TAX TYPES Philippine, Personal income tax (pit) rates; Unless impracticable, a husband and wife must file one consolidated income tax return, but the.

This Calendar Is Issued Prior To The Release Of The Official Schedule Prepared By The Bureau Of Internal Revenue And Other Government Offices.

The commissioner of internal revenue (cir) has issued rmc no.

Availability Of Bir Form Nos.

The philippines taxes its resident citizens on their worldwide income.