Irs Estimated Tax Payments 2025 Forms

Keep this list of key 2025 irs tax filing dates handy. 90% of your estimated 2025 taxes.

Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your. While the 1040 relates to the previous year, the estimated tax.

Make Tax Deposits, Estimated Taxes,.

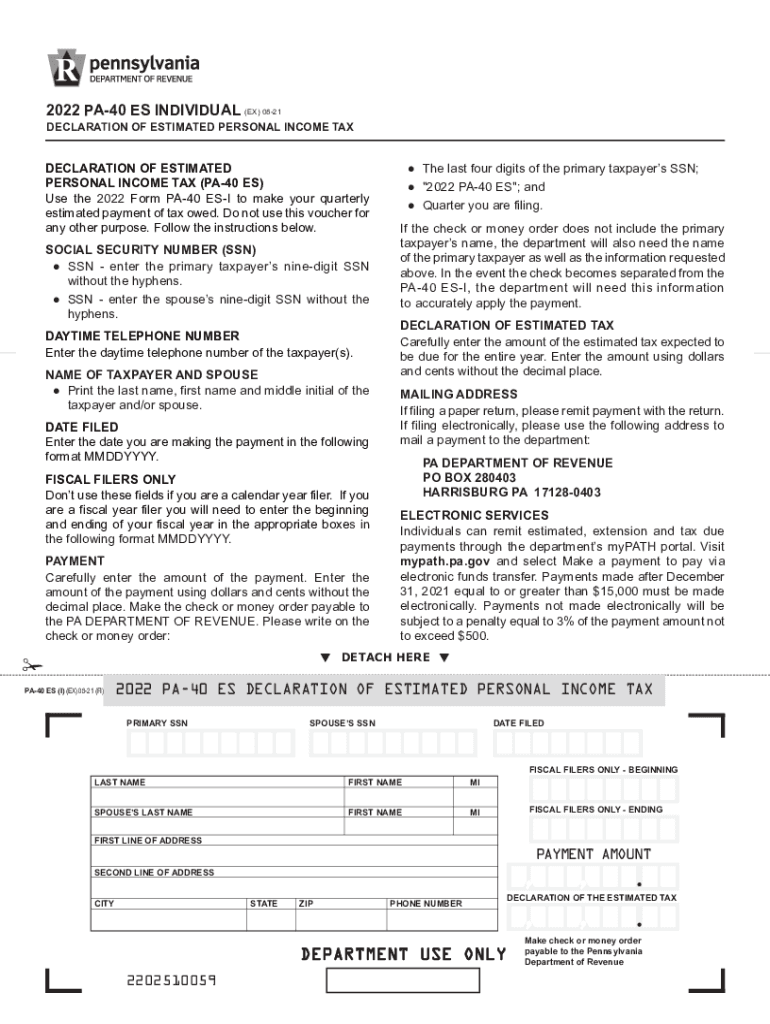

Quarterly estimated tax payments for.

The First Line Of The Address Should Be Internal Revenue Service Center.

Use of those vouchers is optional.

Images References :

Source: williamperry.pages.dev

Source: williamperry.pages.dev

Estimated Tax Forms For 2025 Perry Brigitta, This year, april 15 is the deadline for taxpayers to file 2025 federal income tax returns. No, you are not required to do anything with those estimated tax vouchers for 2025.

Source: lorrainekaiser.pages.dev

Source: lorrainekaiser.pages.dev

When Will The Irs Finalize Forms For 2025 Ketty Merilee, If you are required to make estimated payments, yes, you can pay them. The interest rate for an individual's unpaid taxes is currently 8%, compounded daily.

Source: www.dochub.com

Source: www.dochub.com

Maryland form pv Fill out & sign online DocHub, Use of those vouchers is optional. Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your.

Source: kimwmelton.pages.dev

Source: kimwmelton.pages.dev

Form 1120W 2025 Andra Blanche, Irs federal tax payments deadline 2025 tax deposit deadlines vary depending on factors such as the type of return and past filing history, differing from. If you are required to make estimated payments, yes, you can pay them.

Source: www.signnow.com

Source: www.signnow.com

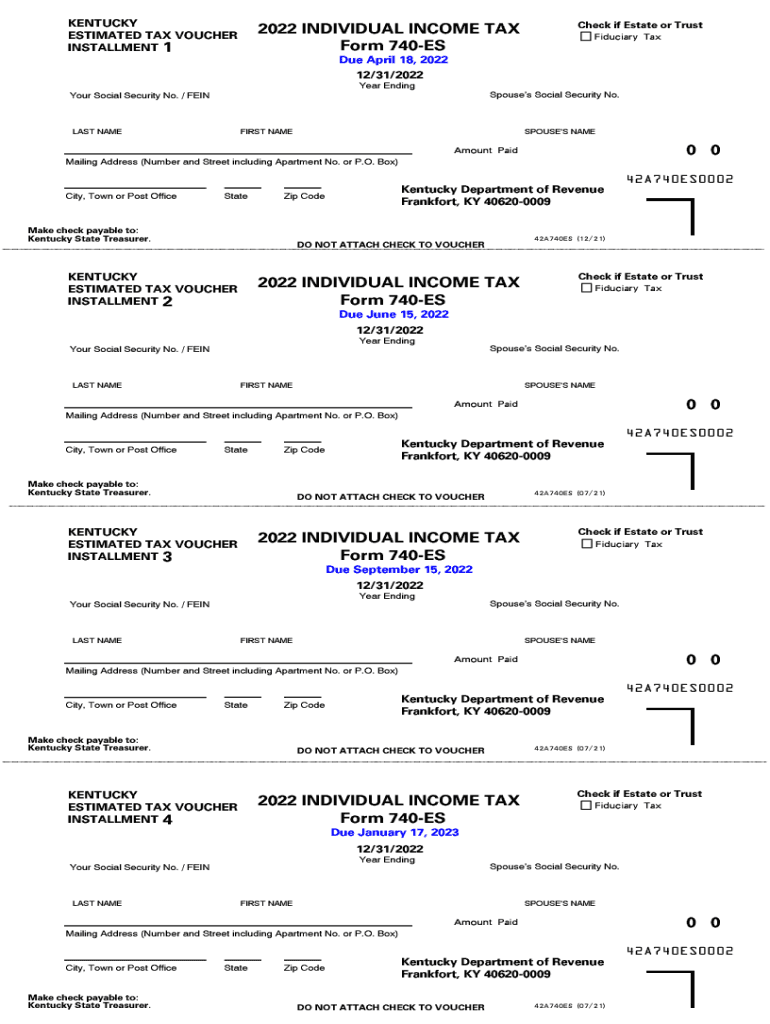

Ky 740 Es 20222025 Form Fill Out and Sign Printable PDF Template, Estimated quarterly tax payments are due four times per year, on the 15th of april, june, september, and january (or the next business day if it’s a weekend or holiday). Make payments from your bank account.

Source: www.templateroller.com

Source: www.templateroller.com

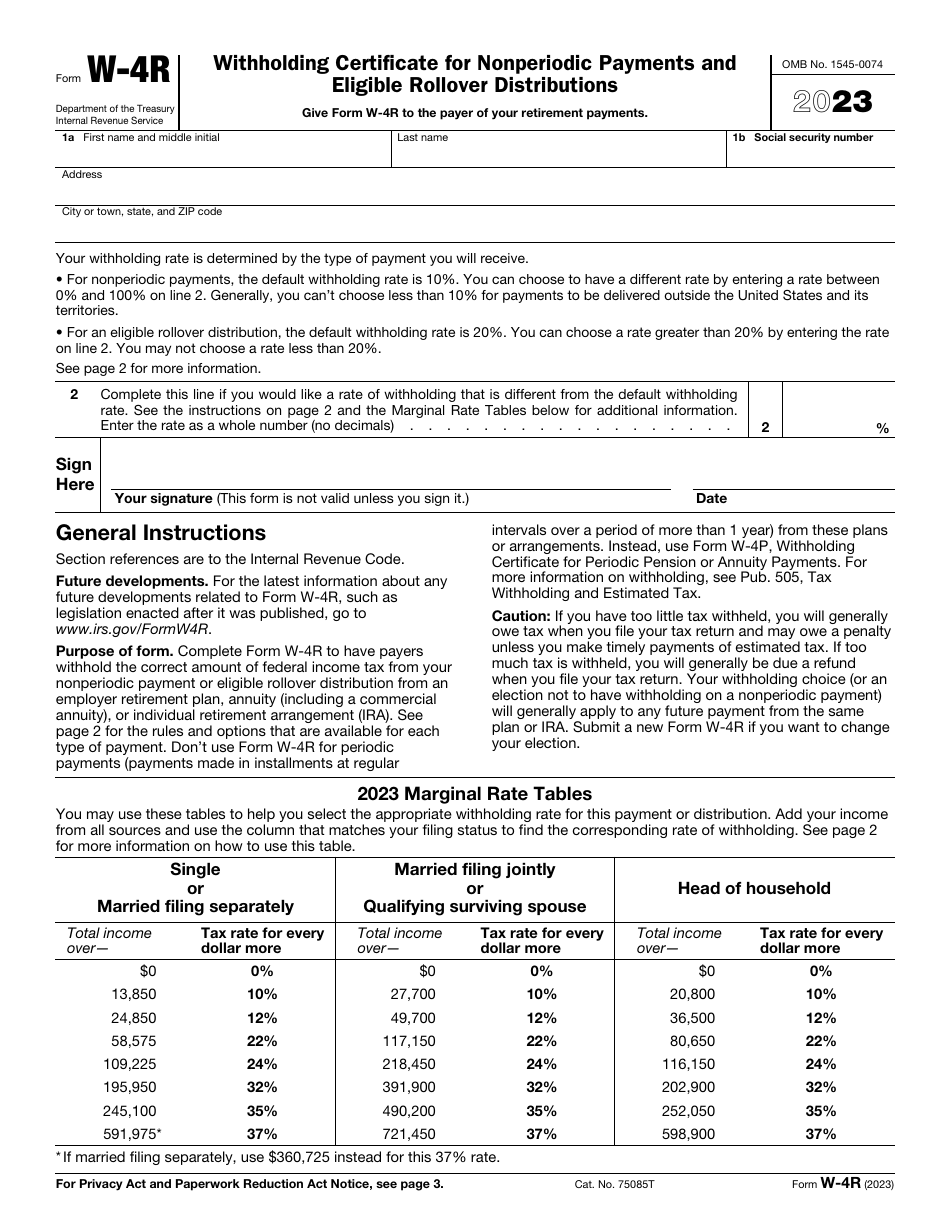

IRS Form W4R Download Fillable PDF or Fill Online Withholding, The 2025 quarterly estimated tax deadlines are: There are four payment due dates in 2025 for estimated tax payments:

Source: www.signnow.com

Source: www.signnow.com

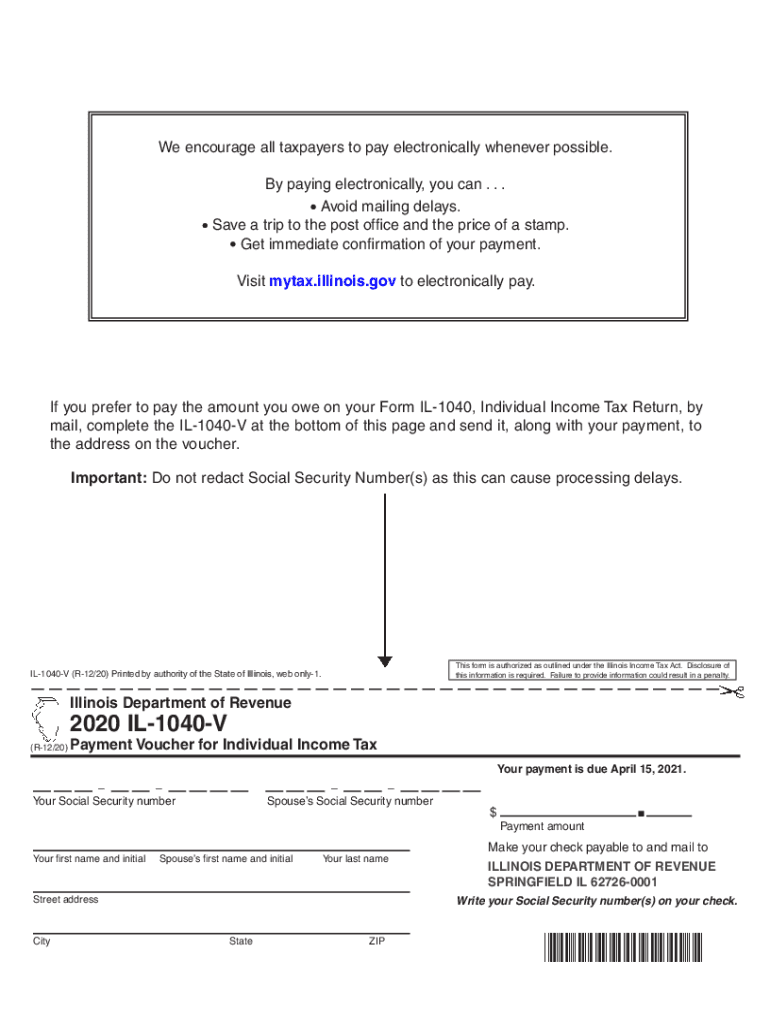

Illinois 1040v 20202025 Form Fill Out and Sign Printable PDF, Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your. Direct pay with bank account.

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

Irs Form For Quarterly Taxes 2025 Neala Viviene, Corporations generally must make estimated tax payments if they expect to owe tax of $500 or more when their return is filed. Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

Source: nataliejones.pages.dev

Source: nataliejones.pages.dev

Estimated Tax Due Dates 2025 Form 2025Es 2025 Angele Valene, By the end, you’ll feel more equipped to navigate estimated. You are not required to use the 1040es vouchers or make estimated quarterly payments.

Source: lorrainekaiser.pages.dev

Source: lorrainekaiser.pages.dev

Where To Send 2025 Estimated Tax Payments Meggy Silvana, This year, april 15 is the deadline for taxpayers to file 2025 federal income tax returns. What are estimated tax payments?

Use This Secure Service To Pay Your Taxes For Form 1040 Series, Estimated Taxes Or Other Associated Forms Directly From Your.

Direct pay with bank account.

Make Payments From Your Bank Account.

Sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax payment system (eftps) enrollment required to use this option.

Posted in 2025